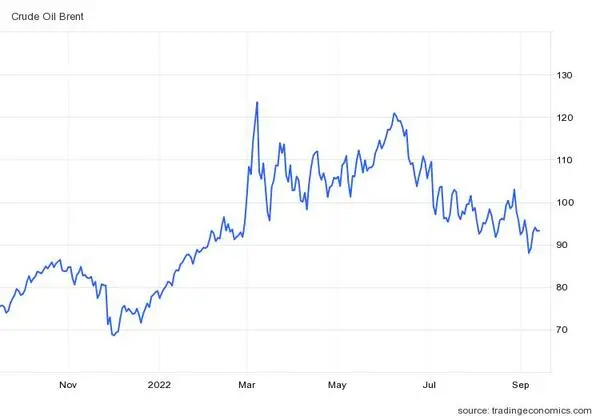

Brent crude futures have fallen under $93 per barrel Wednesday. Moving further from a week-long high hit and in the earlier session. Being considerably more robust than had been anticipated in the latest statistics on US inflation has given a rise to concerns that the federal reserve may take even more drastic action to combat rising prices. The market is predicting that the United States fabric reserve will deliver a larger rate Hike of 100 bases points the following week which will drive a fresh search in the dollar while also putting pressure on oil and other risk assets because it could reduce overall concerns about the ongoing COVID 19 limitations imposed by the world’s largest crude oil importer China why persisted among investors. On the supply side, industry data that was provided on Tuesday show that us oil stocks group by approximately 6 million barrels during the previous week while traders made for official data to be assured by the EIA on Wednesday. In the meantime, the organisation of petroleum exporting countries ( OPEC) predicted in a monthly report that was made public on Tuesday that the global demand for oil will increase by 3.1 million barrels per day in 2022 and 2.7 BPD in 2023 re8 rating its earlier projections for healthy expansion.